SiraEdge Portfolio Platform

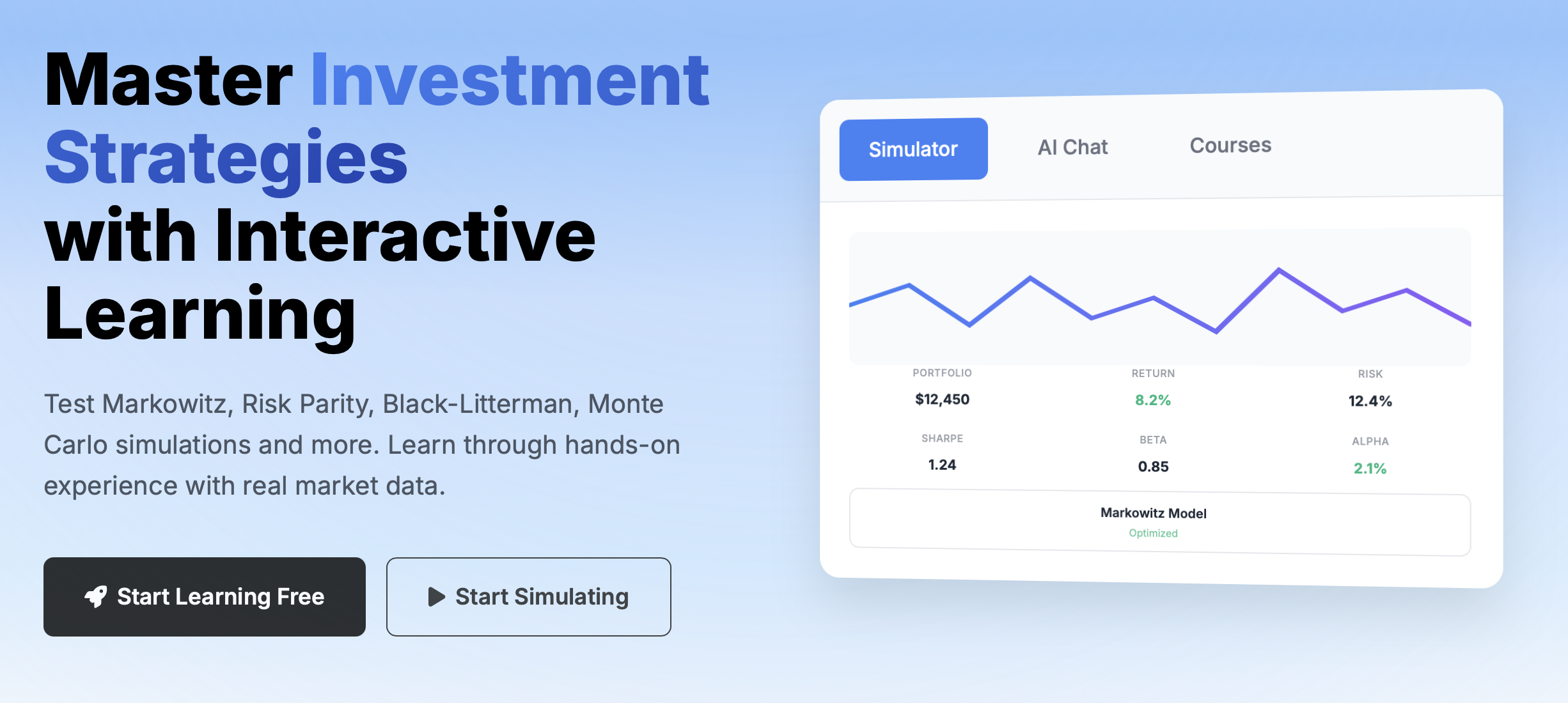

How do you democratize access to professional-grade portfolio optimization tools? Discover SiraEdge, a comprehensive platform combining 7 advanced models with educational resources to make finance accessible to everyone.

Introduction

SiraEdge was born from a simple observation: professional-grade portfolio optimization tools are typically reserved for institutional investors and wealth managers, leaving individual investors and students without access to sophisticated financial modeling capabilities. This project represents my journey in democratizing quantitative finance through an educational platform that combines cutting-edge optimization models with intuitive interfaces.

The platform implements seven state-of-the-art portfolio optimization models, each with its own strengths and use cases. From the classic Markowitz mean-variance optimization to advanced machine learning approaches, SiraEdge provides users with the tools to understand, experiment with, and apply professional investment strategies.

Technical Implementation

The core of SiraEdge is built in Python, leveraging NumPy and Pandas for efficient numerical computations and data manipulation. The platform integrates with yfinance for automated data retrieval, ensuring users can analyze any publicly traded asset without manual data entry.

One of the key challenges was implementing walk-forward backtesting with rolling windows. This approach ensures that optimization models are tested on out-of-sample data, providing more realistic performance estimates. The system uses 252-day rolling windows with monthly rebalancing, simulating real-world portfolio management constraints.

"The goal isn't just to optimize portfolios—it's to make quantitative finance accessible. Every user should understand why a model recommends certain allocations, not just accept the output blindly."

— Ismail Moudden, Founder & Product Lead

Key Features

SiraEdge implements seven distinct optimization models, each serving different investment philosophies and risk profiles:

- Markowitz Optimization: Classic mean-variance optimization balancing risk and return

- Risk Parity: Equal risk contribution across assets

- Monte Carlo Simulation: Testing 10,000+ portfolio combinations

- Black-Litterman: Incorporating market views and equilibrium returns

- ML Ridge Regression: Machine learning approach to return prediction

- Hybrid Model: Combining multiple optimization strategies

- Custom Metrics: User-defined optimization objectives

Beyond optimization, the platform includes comprehensive risk management features. Dynamic correlation analysis helps identify regime changes, while technical indicators (RSI, momentum, volatility) provide additional context for portfolio decisions.

Impact & Future

SiraEdge represents more than a technical project—it's a mission to democratize finance education. By combining professional-grade tools with educational content, the platform enables users to learn by doing, experimenting with different strategies and understanding the underlying mathematics.

The integration of SiraChat, an AI assistant, further enhances the educational mission. Users can ask questions about model outputs, understand portfolio behavior, and receive explanations in natural language, making complex financial concepts more accessible.